Time

- Alexandre Marro

- Feb 20

- 4 min read

The river,

surging course,

Uninterrupted current.

Headwater,

channel, mouth.

Can they be divided? The Future of Money: Introduction & Hypothesis

Today, as the U.S. dollar faces increasing challenges, a transition toward decentralized assets like gold and crypto is an inevitability. This will be a series of analytical posts to give broad coverage to both the fundamental / historical aspects underlying the changes in trends.

Null hypothesis: Crypto is not a viable alternative to Fiat Currency and Precious Metals as a Reserve Currency.

Alternative Hypothesis: Crypto is a viable alternative to Fiat Currency and Precious Metals as a Reserve Currency.

I will therefore explore the price action, history, and trend of the USD, Gold, and BTCUSD to validate / invalidate the null hypothesis.

What is a Reserve Currency?

A reserve currency is a widely accepted form of money held by central banks and financial institutions for international trade, financial stability, and economic influence. It ensures liquidity, reduces exchange rate risks, and serves as a global benchmark for pricing commodities like oil, gold, and raw materials.

The Transition from Gold to the U.S. Dollar as the Global Reserve Currency

Before the U.S. dollar dominated, gold was the global reserve currency. For centuries, economies backed their currencies with physical gold under the gold standard, ensuring that paper money could be exchanged for a fixed amount of gold. This system created financial stability but had limitations—gold supplies couldn’t always match economic growth, leading to deflationary pressures.

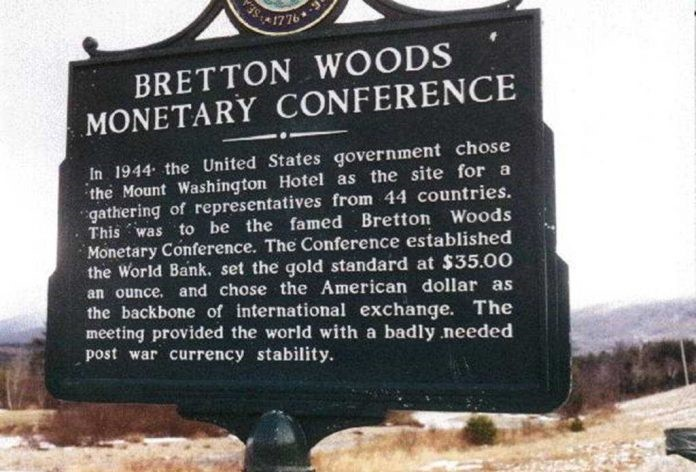

Bretton Woods Agreement – The Rise of the U.S. Dollar June 1944

After World War II, the world needed a new financial system. In 1944, world leaders gathered at the Bretton Woods Conference, where they agreed to:

Peg global currencies to the U.S. dollar, rather than directly to gold.

Fix the U.S. dollar to gold at $35 per ounce, making it as good as gold for international trade.

This made the U.S. dollar the global reserve currency, as countries preferred to hold dollars rather than gold. The U.S. economy was the strongest post-war, and its gold reserves were the largest in the world, securing confidence in the system.

The Nixon Shock – End of the Gold Standard August 15 1971

By the late 1960s, the U.S. was printing more money than its gold reserves could back, due to debt from the Vietnam War and welfare spending. Foreign nations, worried about the U.S.’s ability to redeem dollars for gold, started demanding gold in exchange for their dollar reserves.

In 1971, President Richard Nixon unilaterally ended the gold standard (known as the Nixon Shock), meaning:

The dollar was no longer backed by gold.

Fiat money (government-backed currency with no intrinsic value) replaced gold as the foundation of global finance.

This allowed the U.S. government to print unlimited money, leading to inflation but also giving it immense economic power.

The Petrodollar System – Cementing U.S. Dollar Dominance June 9 1974

After leaving the gold standard, the U.S. needed a way to maintain demand for the dollar. In 1974, the U.S. struck a deal with Saudi Arabia to price oil exclusively in U.S. dollars in exchange for military protection. Other oil-producing nations followed, creating the petrodollar system, which forced countries to hold USD to buy oil. This reinforced the U.S. dollar as the global reserve currency, despite no longer being backed by gold.

Future Scenario: Cryptocurrency as the Next Global Reserve Currency

Imagine a world where Bitcoin (BTC), Ethereum (ETH), or a new decentralized cryptocurrency becomes the global reserve currency, replacing the U.S. dollar.

This could happen due to:

Loss of Trust in Fiat Currencies: High U.S. debt, money printing, and inflation erode confidence in the dollar, leading nations to seek a decentralized alternative.

Decentralization & Transparency: Unlike fiat currencies controlled by central banks, crypto operates on public blockchains, eliminating manipulation by governments.

Digital Efficiency & Instant Transactions: Cryptocurrencies enable borderless payments, reducing international trade costs and eliminating the need for intermediaries like banks.

Neutrality: No single country would control the global reserve, reducing economic warfare through sanctions or currency manipulation.

President Donald Trump listens to White House adviser David Sacks as he signs an executive order regarding cryptocurrency in the Oval Office of the White House, Thursday, Jan. 23, 2025, in Washington. (AP Photo/Ben Curtis, File)

Why Crypto as a Reserve Currency May Be Better

Fixed Supply & Inflation Resistance

Unlike the dollar, which can be printed infinitely, Bitcoin has a fixed supply of 21 million coins, preventing governments from inflating away debt.

A crypto-based reserve currency would force fiscal discipline.

Decentralization Reduces Corruption

Central banks manipulate fiat currencies for political or economic gain. A blockchain-based reserve would be fully transparent and tamper-proof.

Financial Inclusion & Global Access

Billions of people worldwide lack access to banking. A crypto-based reserve would allow anyone with an internet connection to participate in global finance.

Smart Contracts & Automated Transactions

A crypto reserve system could integrate smart contracts, allowing instant and automatic execution of international agreements (e.g., trade deals, loans, and taxation).

Energy & Security

While Bitcoin currently uses a Proof-of-Work system (energy-intensive mining), future crypto reserves may adopt sustainable Proof-of-Stake models or quantum-resistant cryptography for enhanced security.

Challenges & Roadblocks

Regulatory Pushback: Governments and central banks will fight against losing control over monetary policy.

Volatility: Bitcoin’s price swings make it unpredictable, though a crypto stablecoin reserve (backed by assets) could mitigate this.

Infrastructure & Adoption: The global economy is deeply entrenched in fiat, making a rapid transition difficult.

Cybersecurity Threats: Hacking risks and vulnerabilities in digital wallets could be an obstacle.

The transition from gold to the U.S. dollar as the global reserve currency was driven by economic and geopolitical dominance. However, as trust in fiat currencies declines, cryptocurrencies may become the next evolution in global finance.

A decentralized, blockchain-based reserve currency would create a transparent, inflation-resistant, and borderless financial system—but governments and banks will fight to maintain control. While the U.S. dollar won’t be replaced overnight, the future of money is changing.... All too often, we tend to think ofabsorption as a static thing: Water is absorbed into a sponge, and there it stays. But true ab sorption is a total involvement in the evolution oflife without hesitation or contradiction. In nature there is no alienation. Everything belongs.

Comments