Shaping

- Alexandre Marro

- Feb 13

- 2 min read

"Potter at the wheel.

From centering to finished pot,

Form increases as options decrease;

Softness goes to hardness"

Today I will take you through the general process of creating and realizing an options strategy. I will use an example from my trading account that started and finished within 2 days from yesterday to today.

Broad Market Analysis Chart of the S&P500 gives you market directionality

This is the original chart available to the public

1 component of My technical analysis overlayed Sector Analysis

Determines what sector I will be looking to trade Pattern Analysis & Picking the Stock

Based on my Parameters, this is what I see. From here, I pick the best patterns, Individual Security Analysis Based on my screening process, I identified APP as a potential trade. During the analysis, entry and exit points are identified, stratification of buy/sell orders are determined, and

This is what I see when I am scanning - this is the chart from yesterday (2/12/25)

This is what I see after I perform my technical analysis Options Strategy An option is a contract that allows the holder the right to buy or sell an underlying asset or financial instrument at a specified strike price on or before a specified date, depending on the form of the option. Advantages of trading options include: Increased Leverage, Position Hedging, Time Sensitivity, Risk Mitigation After performing Technical Analysis of the underlying stock, I analyze the options contracts offered. This includes analyzing volatility, time decay, intrinsic value, and open interest (the number of contracts or commitments outstanding in futures and options trading on an official exchange at any one time)

Options Chain - This is what you see if a stock / security has options available to trade Position Management After entering a trade, position management involves monitoring price action within the time frame of the trade. It is therefore crucial to set definitive time frames and rules regarding the price action and trajectory within the time interval.

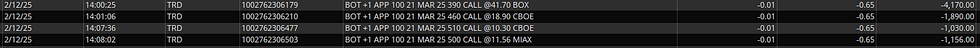

TRADE ENTRY AND RESULTS -

POST TRADE ANALYSIS APP had many factors that demonstrated ideal selection criteria. The price broke out exactly at the level forecasted Every price target was hit and profits locked in Favorable earnings report resulted in high volatility

"We shape all the situations in our lives. We must give them rough shape and then throw them down into the center of our lives. We must stretch and compress, testing the nature of things. As we shape the situation, we must be aware of what form we want things to take. The closer something comes to completion, the harder and more definite it becomes. Our options become fewer, until the full impact of our creation is all that there is."

Comments